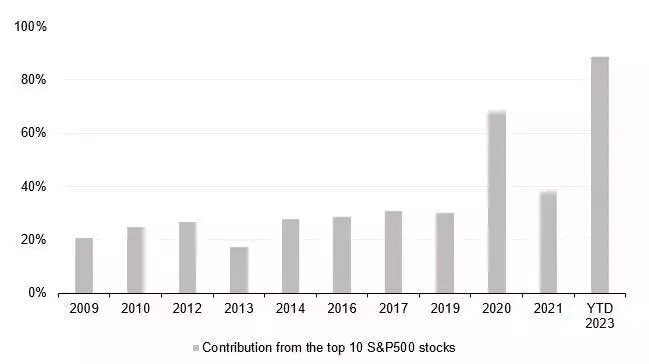

The stock market returns in 2023 have been heavily concentrated in a select few companies, according to French bank Societe Generale. In fact, the top 10 best-performing stocks in the S&P 500 have accounted for a whopping 89% of the index’s gains so far this year. This level of concentration hasn’t been seen in at least 15 years, Societe Generale noted.

The chart provided by the bank clearly shows the dominance of these top companies in driving the overall performance of the stock market. With just two months remaining in the year, these top performers continue to have a significant impact on the S&P 500’s performance.

“This is by far the narrowest performance in the post-GFC era if we count years in which the S&P 500 has gained at least 10%,” stated Societe Generale.

Interestingly, this trend aligns with a recent study conducted by the Federal Reserve, which found that median US firms have experienced lower profit margins over the past decade, while larger companies have consistently grown their margins.

However, some experts believe that the gap between the biggest players and the rest of the market may eventually narrow. Richard Bernstein, the chief investment officer of Richard Bernstein Advisors, expressed optimism that an improving market could shift investors’ focus towards small and mid-cap stocks. He believes that lower-profile names have the potential to deliver bigger returns in the next decade.

Bernstein referred to the dominant companies as the “Magnificent Seven”, consisting of Alphabet, Apple, Amazon, Meta Platforms, Nvidia, Microsoft, and Tesla. These stocks have experienced significant gains, but their extreme valuations raise questions about whether they truly represent the best growth opportunities in the global equity market.

“Despite profits growth becoming more abundant, investors generally continue to focus on the so-called Magnificent 7 stocks,” stated Bernstein. “Such narrow leadership seems totally unjustified and their extreme valuations suggest a once-in-a-generation investment opportunity in virtually anything other than those 7 stocks.”

Bernstein emphasized the need to explore other growth stories beyond the well-known giants and questioned whether these seven stocks are truly the best growth opportunities available.

As investors navigate the stock market landscape, it will be interesting to see if the concentration of gains among a handful of companies continues or if a broader range of stocks begins to attract attention.

I have over 10 years of experience in the cryptocurrency industry and I have been on the list of the top authors on LinkedIn for the past 5 years.