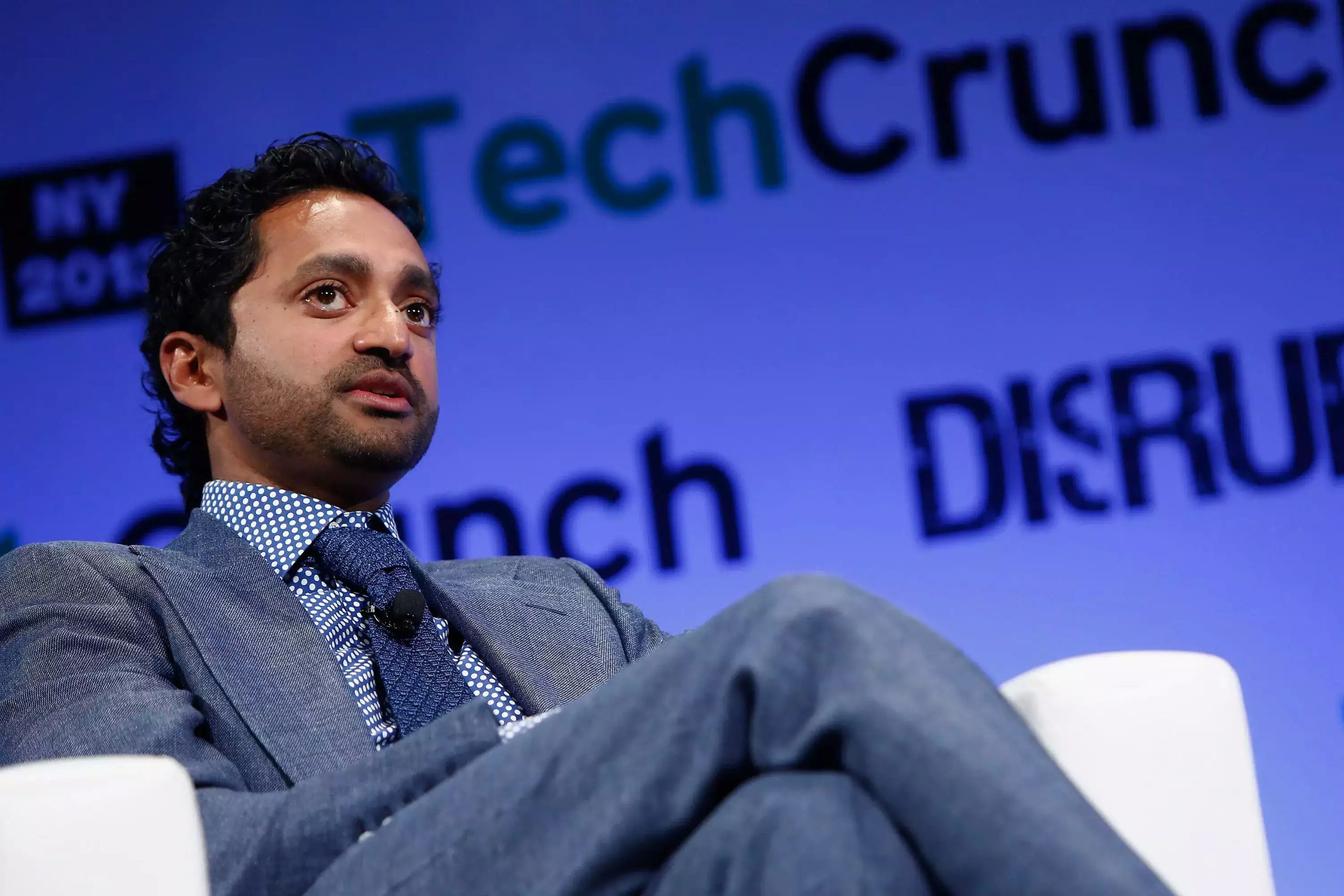

Billionaire investor Chamath Palihapitiya recently presented his views on how AI could potentially change the role of venture capitalists. During an episode of the “All-In Podcast,” he pointed out that AI could lead to significant changes in the industry. Palihapitiya, who is the CEO of Silicon Valley VC firm Social Capital, believes that AI productivity gains could result in a higher number of startups made up of smaller teams, leading to investors making a higher proportion of smaller bets. He also suggested that financial engineering would undergo transformation in this scenario, profoundly changing the job of the venture capitalist. This discussion reflects broader concerns about the impact of AI on job roles, particularly in industries like finance. For example, Deutsche Bank has been testing tools that could streamline tasks traditionally performed by junior bankers, sparking fears about potential job reductions in the sector. With the rapid advancements in AI, there are expectations of improved productivity and the automation of tedious tasks, but there are also concerns about the potential displacement of certain roles. Palihapitiya’s perspectives shed light on the evolving landscape of venture capitalism in the age of AI.

I have over 10 years of experience in the cryptocurrency industry and I have been on the list of the top authors on LinkedIn for the past 5 years.