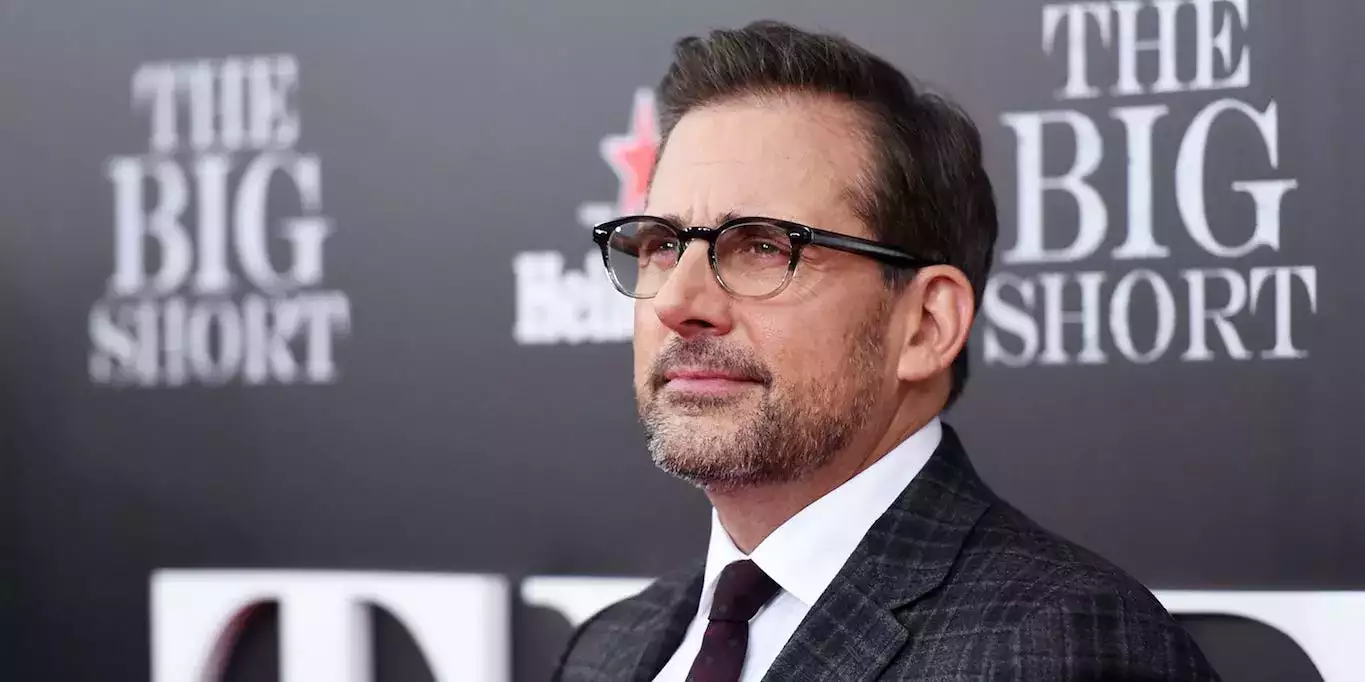

Federal Reserve Chairman Jerome Powell’s decision to pause rate hikes in light of economic uncertainty has left investors baffled, according to renowned investor Steve Eisman. Eisman, famous for predicting the 2008 market crash, believes that Powell is just as confused as everyone else by the conflicting economic data. In an interview with CNBC, Eisman stated, “Maybe that’s why he wants to pause, because he doesn’t know what to do.”

One of the reasons for the uncertainty is the mixed signals coming from the economy. Consumer spending has been strong, but borrowing costs have increased, which threatens demand for big-ticket items such as homes and cars. Powell acknowledged the impact of high mortgage rates on the housing market, but also suggested that households and small businesses may have stronger balance sheets than previously thought.

While the market anticipates that the Federal Reserve’s hiking cycle is over, Eisman dismissed the possibility of near-term interest rate cuts. He believes that unless there is a significant recession, the Fed is more inclined to keep rates where they are to avoid a repeat of the 1980s when premature loosening led to a resurgence of inflation.

In contrast, investor Jeffrey Gundlach predicts a recession and advises buying long-dated Treasurys. However, Eisman disagrees with this prediction, stating, “I think it’s way too early to be making that kind of prediction. I wouldn’t be doing that.”

The uncertainty in the economy and conflicting opinions among experts have left both investors and the Federal Reserve questioning the next steps. With no clear consensus, the future direction of interest rates remains uncertain.

I have over 10 years of experience in the cryptocurrency industry and I have been on the list of the top authors on LinkedIn for the past 5 years.