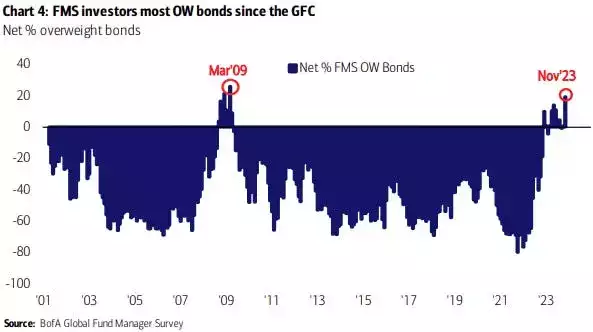

Professional investors are showing extreme optimism toward bonds, reaching levels not seen since the depths of the Great Financial Crisis, as indicated by Bank of America’s chart of the day.

A recent survey of professional investment fund managers by Bank of America revealed that they are the most heavily invested in bonds since early 2009. The only times they were more heavily invested in bonds than they are now were in March 2009 and December 2008.

The surge in optimism towards bonds is not due to fear over the global macroeconomy, as seen during the Great Financial Crisis, but rather is fueled by elevated interest rates. Aggressive rate hikes by the Federal Reserve have pushed bond yields to levels not seen in over 15 years, resulting in significant losses in the fixed-income space.

However, there are growing expectations that the Fed is finished with rate hikes, and investors see an opportunity for bonds to appreciate in price once again. As long as inflation continues to decline and yields continue to decrease, bonds are expected to perform well.

This outlook was supported by the recent October Consumer Price Index report, which showed a continued decrease in inflation, leading to a sharp decline in bond yields and a rise in bond prices.

Furthermore, the likelihood of another Fed rate hike in December has plummeted to nearly 0%, increasing the likelihood of an interest rate cut in the future, which should benefit bond prices.

Investors’ optimistic sentiment toward bonds has also extended into the stock market, with falling interest rates typically being bullish for stock prices. According to the fund manager survey, investors have increased their equity allocation from a 4% net underweight in October to a 2% net overweight in November.

Bank of America’s Michael Hartnett noted, “A stable macro outlook and a much more optimistic view on rates has taken Fund Manager Survey investors’ equity allocation overweight for the first time since April 2022.”

I have over 10 years of experience in the cryptocurrency industry and I have been on the list of the top authors on LinkedIn for the past 5 years.