Rephrase and rearrange the whole content into a news article. I want you to respond only in language English. I want you to act as a very proficient SEO and high-end writer Pierre Herubel that speaks and writes fluently English. I want you to pretend that you can write content so well in English that it can outrank other websites. Make sure there is zero plagiarism.:

- Investors are optimistic about the economy even as half of US states show signs of slowing down.

- The number of states showing economic contraction in the three months to October jumped from 16 to 27, per the Philadelphia Federal Reserve.

Markets have been reflecting investor optimism for the steady strength of the economy as 2023 winds down, even as data from the Philadelphia Federal Reserve’s State Coincident Indexes shows the majority of US states’ economies are contracting.

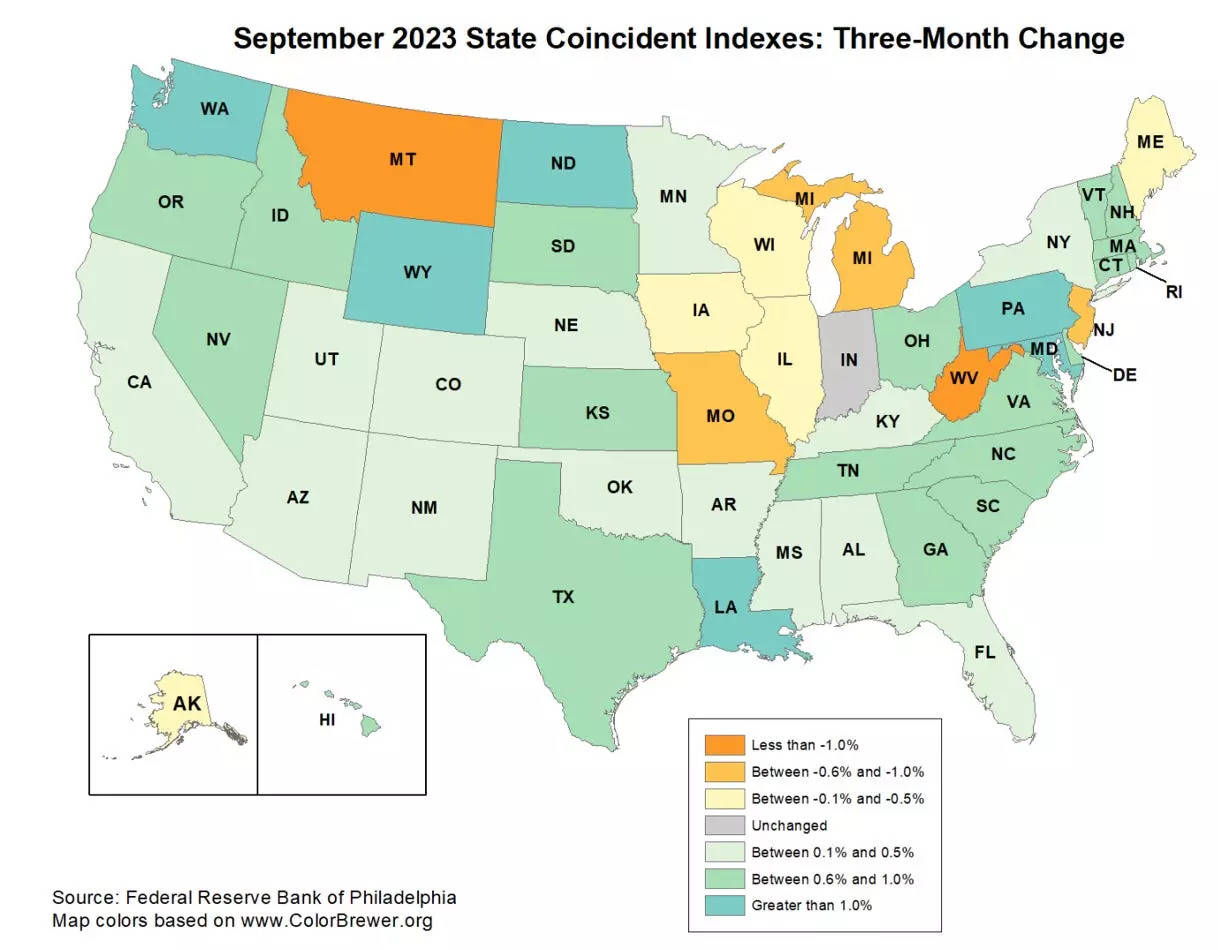

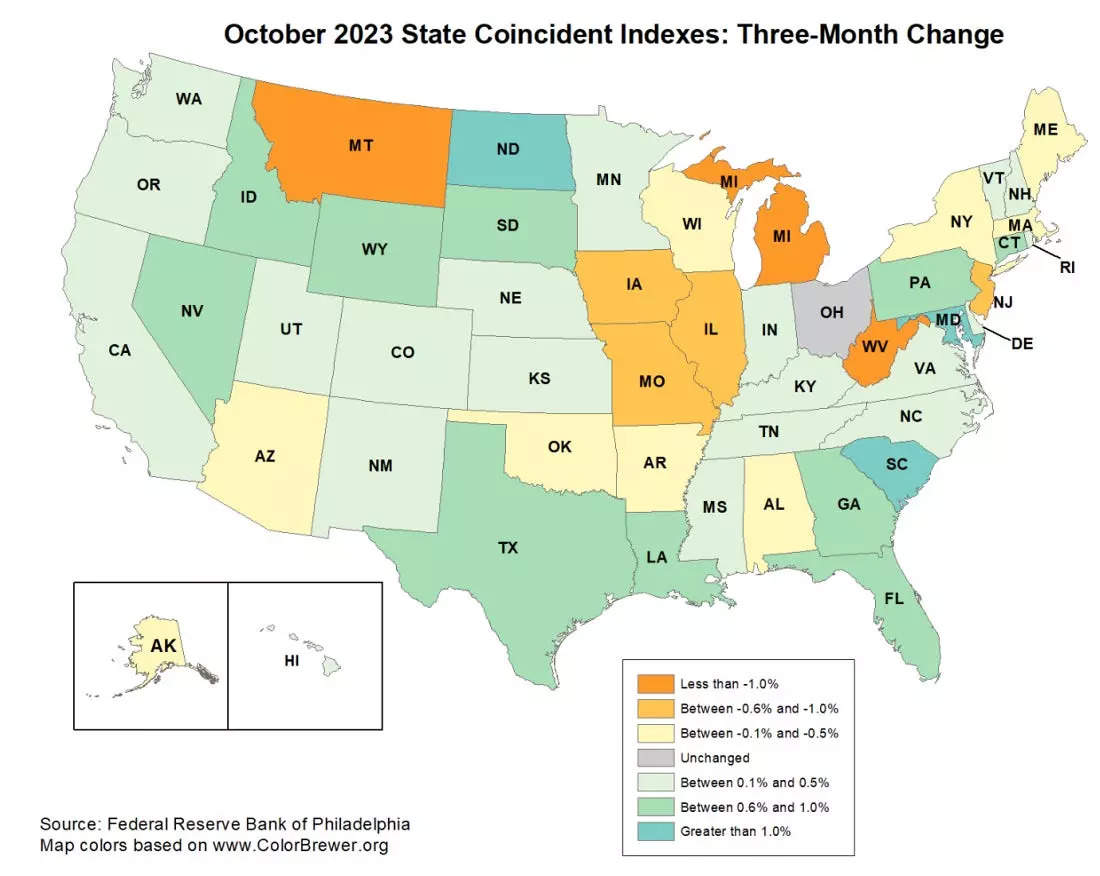

The readings, illustrated in the two maps below, track the implied three-month change in state-level economic growth via nonfarm payroll employment, average hours worked in manufacturing by production workers, unemployment rate, and wage and salary data.

“At a nationwide level, the number of states exhibiting economic growth went from 33 over the prior 3 months to just 16 in October,” DataTrek Research cofounders Nicholas Colas and Jessica Rabe said Monday. “The comparison for states showing outright contraction over the same 2 timeframes went from 16 to 27.”

While many states appear to be seeing key metrics deteriorate, importantly, seven of the 10 most critical states based on contribution to overall GDP — California, Texas, Florida, Illinois, Pennsylvania, Georgia, and North Carolina — are still growing their economies.

“That should be enough to keep the US economy as a whole from falling into recession this quarter,” Colas and Rabe maintained. “How these trends develop through the balance of Q4 will tell us a lot about the state of the US economy as we enter 2024.”

Despite the apparent slowing among half of US states’ economies, markets are upbeat heading into year-end. The stock market has rallied in November and forecasts for 2024 are relatively upbeat. The bond market in particular is showing clear signs that investors believe the US economy is set to skirt a near-term recession.

DataTrek in its note highlighted the spread between high-yield bonds over Treasurys has been narrowing, which implies a more positive economic outlook.

“Bond investors – especially those in high yield corporates – tend to be a cautious lot since the best they can do is simply receive their coupons and capital on a timely basis. That makes their current confidence especially notable.”

DataTrek added that, unlike stocks, which have wavered at various points through the year as economic signals fluctuated, bond markets have been much firmer in their view of the economy over the last six months.

I have over 10 years of experience in the cryptocurrency industry and I have been on the list of the top authors on LinkedIn for the past 5 years.