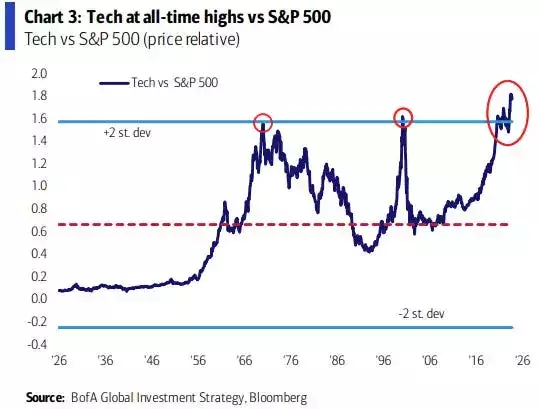

Tech stocks have recently hit all-time highs relative to the S&P 500, a stunning accomplishment according to Bank of America’s Michael Hartnett. This surge in tech stocks has exceeded the high seen during the 1960s bull market and thos seen during the dot-com bubble’s peak in 2000.

The Chart of the Day from Bank of America underscores this outperformance of technology stocks versus the S&P 500. This performance is measured by the relative price performance between technology stocks and the S&P 500.

Michael Hartnett credited the ongoing outperformance in tech stocks to the “AI productivity miracle bull”, while the recent tech rally was supercharged after OpenAI released its ChatGPT chatbot in November 2022. That helped fuel a reversal of last year’s bear market, with the Nasdaq 100 up 43% year-to-date.

The Tech Select Sector SPDR ETF has jumped 47% since ChatGPT was released, far outstripping the S&P 500’s 18% gain over the same period. The bullishness has been driven by the idea that as the adoption of artificial intelligence grows, it will help fuel efficiencies and productivity gains that should boost profits over the long term.

Tech companies at the center of the AI boom are set to see a surge in business as they supply AI-related hardware and software to adopting companies.

This signals a seismic shift in tech stocks and according to Wharton professor Jeremy Siegel, “the promise of AI is real. This year, our growth is being driven by productivity… Higher real growth, more borrowing, more capital investment, I want to be in stocks and not bonds.”

I have over 10 years of experience in the cryptocurrency industry and I have been on the list of the top authors on LinkedIn for the past 5 years.