Rephrase and rearrange the whole content into a news article. I want you to respond only in language English. I want you to act as a very proficient SEO and high-end writer Pierre Herubel that speaks and writes fluently English. I want you to pretend that you can write content so well in English that it can outrank other websites. Make sure there is zero plagiarism.:

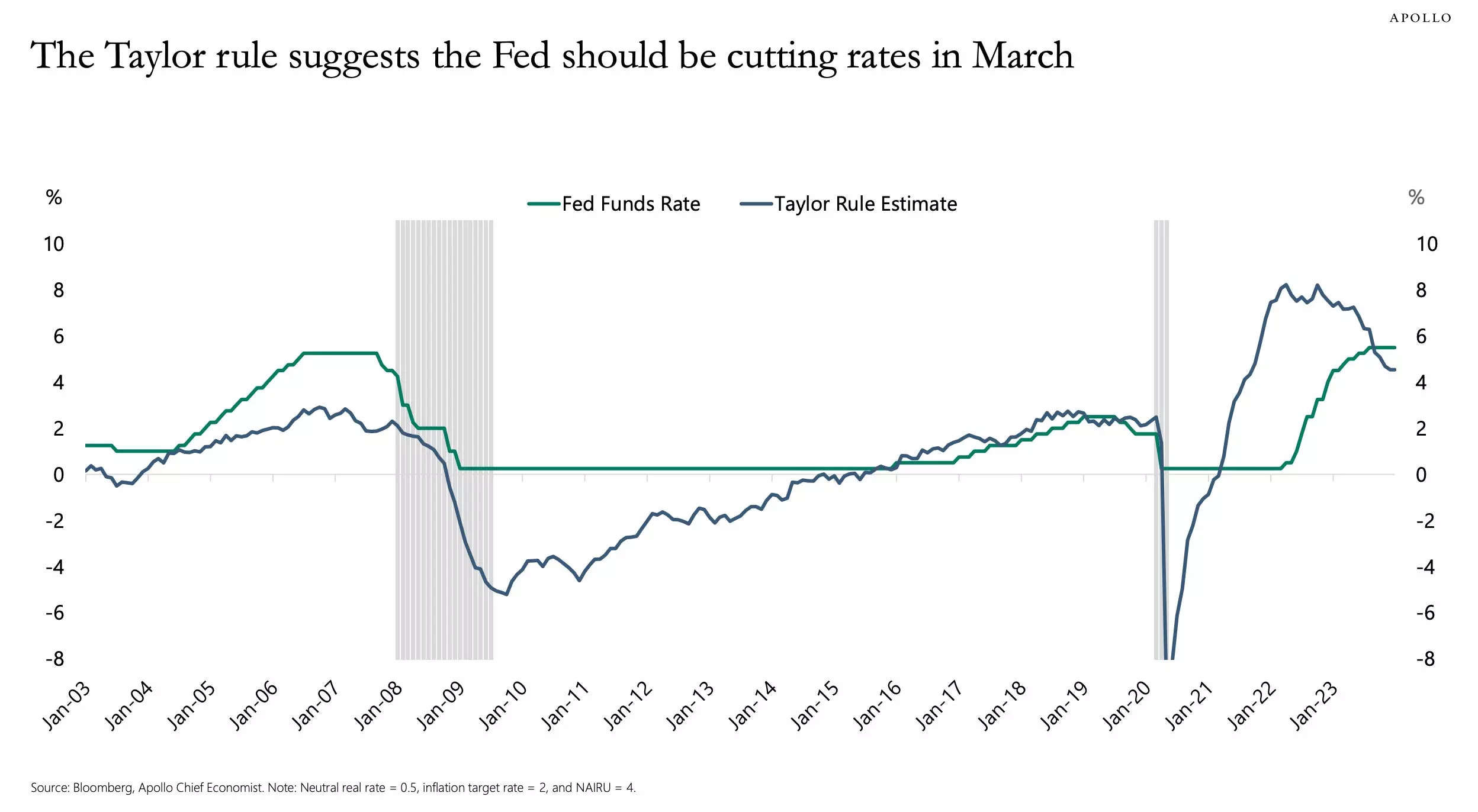

- The fed funds rate should now be at 4.5%, according to the Taylor Rule framework, Apollo’s Torsten Sløk wrote.

- The guideline determines proper interest rates based on inflation and unemployment

Chances that the Federal Reserve starts cutting interest rates in March may still be strong even as the market pushes out its timeline for the central bank to start easing.

That’s according to the Taylor Rule, an indicator that implies that the fed funds rate should by now have fallen to 4.5%, Apollo chief economist Torsten Sløk wrote in his daily commentary. Instead, the rate has remained at a range of 5.25%-5.50%, making a stronger case that the Fed pivots sooner than later.

The Taylor Rule is a gauge long used by the central bank since the 1990s. It outlines where interest rates should land based on inflation and unemployment metrics. For instance, if inflation is too high or unemployment too low, the rule projects higher interest rates.

Looking at the chart, however, rates have not held as closely to the rule’s guidelines — in fact, a year ago, Sløk had questioned whether the fed funds rate shouldn’t stand at 9%, based on this indicator.

And while the Taylor Rule now shows that interest rates may have remained elevated for too long, Wall Street and Fed commentators have been pushing back on hopes that a cutting cycle will start soon.

Some, such as Richmond Fed President Thomas Barkin, have recently warned that further hikes could still be on the table, given sticky inflation and the the risk of additional shocks.

Markets have had a tougher time adjusting to the higher-for-longer rhetoric, as many investors were encouraged by inflation’s slowdown in late 2023 and the Fed’s dovish tone at the December policy meeting. This boosted the odds of a March rate cut to over 80% in the fed fund futures market, though that figure has since slid to just over 50%.

I have over 10 years of experience in the cryptocurrency industry and I have been on the list of the top authors on LinkedIn for the past 5 years.