Rephrase and rearrange the whole content into a news article. I want you to respond only in language English. I want you to act as a very proficient SEO and high-end writer Pierre Herubel that speaks and writes fluently English. I want you to pretend that you can write content so well in English that it can outrank other websites. Make sure there is zero plagiarism.:

- Attacks by Iran-linked rebels in the Red Sea have sent shipping costs soaring.

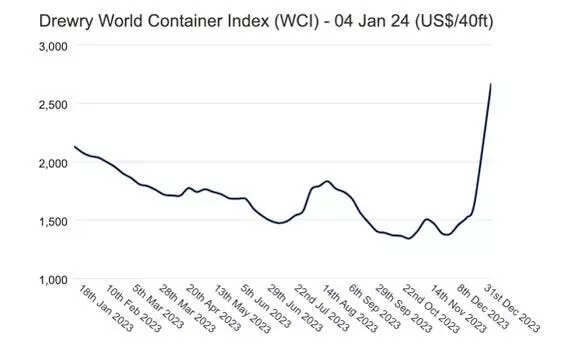

- An index that tracks container rates spiked 61% last week, with big companies rerouting their vessels.

Inflation cooled rapidly across the world last year, but it might be a touch too early for a victory lap.

The Houthis, an Iran-aligned Yemeni militant group, have been attacking ships in the Red Sea. Analysts are warning that their strikes could lead to price pressures flaring up again as big container companies elect to reroute their vessels away from the Suez Canal.

Here’s what you need to know.

Suez Canal stand-off

Since Hamas attacked Israel on October 7, the Houthis have used drones and rockets to target ships in the Red Sea in a bid to pressure Tel Aviv into a ceasefire.

Shipping companies including MSC, Maersk, and Hapag-Lloyd, as well as oil-and-gas giants such as BP, have responded to the attacks by diverting their vessels away from the Suez Canal, the waterway that connects Asia with Europe and the US.

That means container ships are sailing around Africa’s Cape of Good Hope, making journey times about 40% longer, according to The New York Times.

That means it’s taking much longer for everything from crude oil to TVs to sports equipment to travel from Asia to the West.

Shipping costs surge

The Houthis’ attacks are already driving up big shipping companies’ costs.

Drewry’s World Container Index, which tracks global container rates, jumped 61% over the first week of 2024, with the maritime research consultancy attributing the spike to the ongoing chaos in the Red Sea.

Journeys from Singapore to Rotterdam in the Netherlands were most likely to be affected by the disruption, with freight costs jumping 115% to as much as $3,600 per forty-foot box.

As well as causing significant delays, the threat posed by the Houthis has forced shipping companies to pay more for marine insurance – and they could respond by upping their prices in a bid to pass higher costs onto consumers.

Inflation fears intensify

Over the past two years, inflation has cooled to 3.1% in the US, 2.9% in the Eurozone, and 3.9% in the UK thanks to central banks aggressively hiking interest rates in a bid to clamp down on price pressures.

But analysts are worrying that the crisis in the Red Sea could trigger a flare-up.

Many expect the shipping delays to drive up the Brent and West Texas Intermediate oil benchmarks, although those have held steady so far amid signs of a sharp drop in global demand.

But the potential disruption extends far beyond just crude, with 15% of the world’s total shipping traffic passing through the Suez Canal in the Red Sea each year, per Reuters.

Now is “not the time to celebrate the end of inflation,” Crescat Capital macro strategist Octavio Costa said in a post on LinkedIn Friday, linking to data showing soaring container shipping rates. “A second wave is likely underway.”

I have over 10 years of experience in the cryptocurrency industry and I have been on the list of the top authors on LinkedIn for the past 5 years.