SoftBank, a major tech conglomerate and investor, has taken a massive hit of $14.4 billion on its investment in WeWork. The office-sharing company recently filed for bankruptcy, leading to the staggering loss for SoftBank. This revelation comes from the group’s July-September earnings report, which also detailed a loss of $1.5 billion in the first half of 2023 related to its stake in WeWork.

In a significant turnaround, SoftBank recorded an overall loss of $6.2 billion for the period of July to September. This is a striking comparison to the $20 billion profit the company saw during the same period last year.

This downfall for SoftBank comes after WeWork had been propelled to a colossal $47 billion valuation, bolstered by significant investments from the tech conglomerate. There were even predictions that WeWork could reach a $100 billion valuation. However, the relationship between SoftBank founder Masayoshi Son and WeWork’s founder and then-CEO Adam Neumann raised eyebrows. Neumann even claimed that Son once called him “crazy” but suggested that he needed to be even “crazier.”

Despite the high valuation and early optimism, WeWork struggled to reach significant heights. The company faced challenges in the lead-up to its IPO, with doubts lingering about Neumann’s leadership and the fundamental business model. Even after stepping down as CEO, Neumann’s departure was not enough to steer WeWork to success. The pandemic-induced shift towards remote work further weakened the company, ultimately leading to its bankruptcy filing.

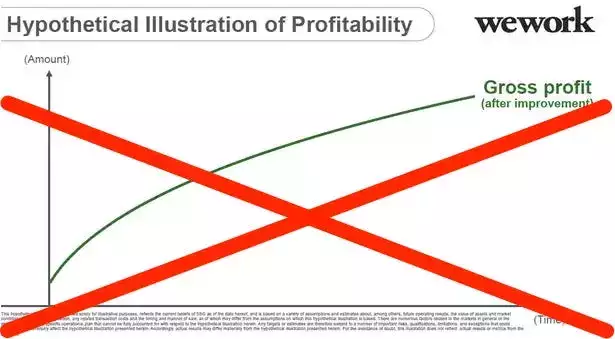

For Masayoshi Son, the WeWork saga has been deeply embarrassing. Even after the company’s initial IPO missteps, Son remained resolute that WeWork could be profitable. His belief was so strong that he presented a chart depicting endless growth in gross profit over an unspecified period of time. However, the stark reality of the losses incurred by SoftBank paints a much different picture.

Following WeWork’s bankruptcy filing, the company is now undergoing a restructuring process with its lenders. This turn of events marks a significant setback for both SoftBank and the once-promising office-sharing company.

I have over 10 years of experience in the cryptocurrency industry and I have been on the list of the top authors on LinkedIn for the past 5 years.