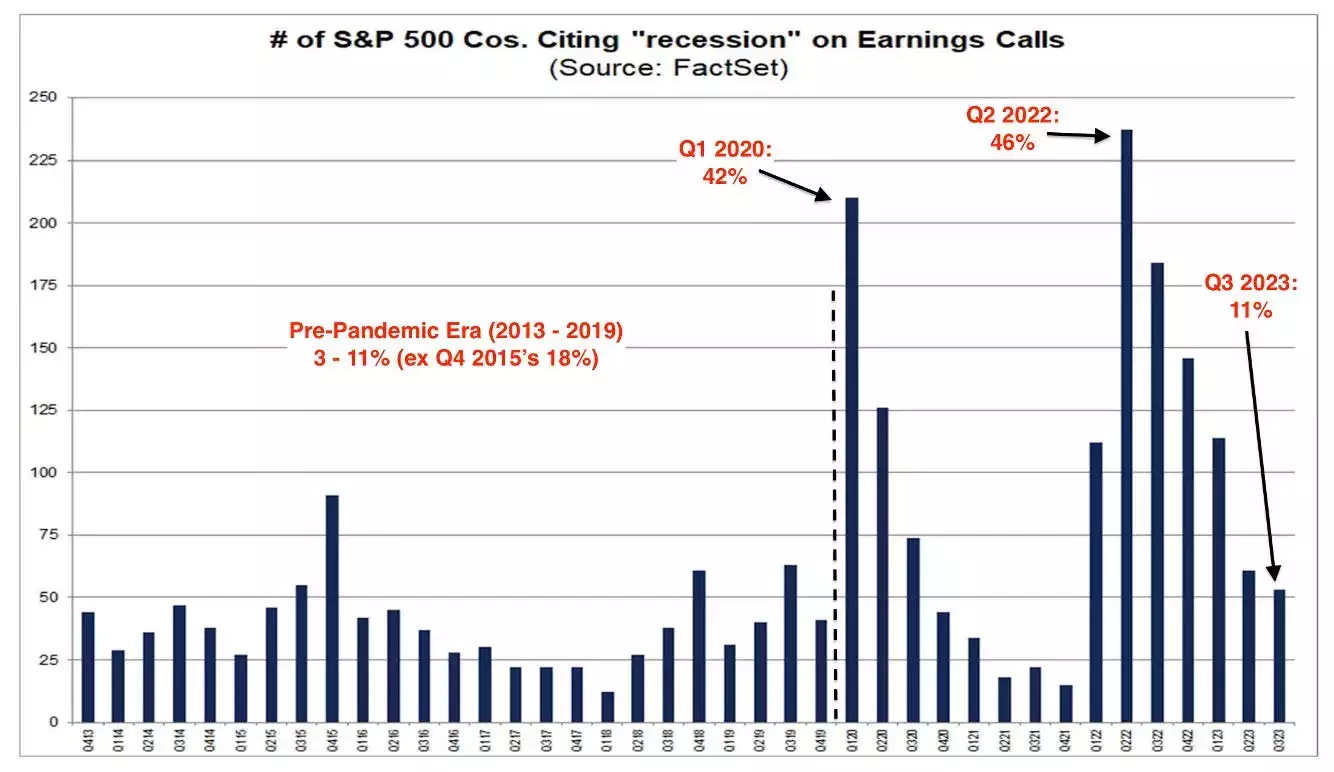

DataTrek Research recently observed that there has been a decline in the number of mentions of the word “recession” during the third quarter earnings calls. Only 11% of management teams referred to a recession, which is a significant drop from the peaks of 42%-46% seen in 2020-2022.

The research firm pointed out that this trend reflects the overall sentiments of corporations regarding the economy as the year comes to a close. As inflation continues to decrease steadily and the labor market shows indications of loosening, it appears that corporate America is feeling less apprehensive about the state of the economy.

DataTrek highlighted that the number of S&P 500 companies mentioning “recession” on earnings calls has been decreasing throughout the year, hovering at 11% in the third quarter. This figure falls within the 3%-11% range observed from 2013-2019 and is considerably lower than the 2020 and 2022 peaks of 42%-46%.

At the same time, DataTrek co-founders Nicholas Colas and Jessica Rabe noted that the number of S&P 500 companies mentioning “inflation” has also declined in the last quarter, dropping to 55% from the peak of 83% seen in 2022. According to DataTrek, this indicates that more than half of all S&P companies still perceive inflation pressures in their cost structures, which they are communicating to Wall Street analysts and investors.

The persistent mentions of “recession” and “inflation” suggest ongoing unease among companies, but it does not necessarily mean negative implications for stock performance. Colas and Rabe pointed out that the focus for next year will be on margin management rather than solely increasing revenues, and as long as the US economy continues to grow, companies should be able to meet or exceed Wall Street analysts’ earnings estimates.

There are conflicting opinions from major Wall Street firms about the outlook for the economy next year. Goldman Sachs maintains a 15% chance of a recession, while JPMorgan strategists have indicated that a downturn seems inevitable. This uncertainty adds to the complexity of gauging the economic landscape as we approach the end of the year.

I have over 10 years of experience in the cryptocurrency industry and I have been on the list of the top authors on LinkedIn for the past 5 years.